philadelphia transfer tax regulations

Recorded in September 2020. Amendment to the Real Estate Transfer Tax Regulation 12-10-21pdf.

7 Reasons Why You Shouldn T Move To Norway Life In Norway

And The Realty Transfer Tax Act 72 P.

. B Additional exclusionsOther transactions which are excluded from tax include. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt. The city of philadelphia imposes a realty transfer tax on the sale or transfer of real property located in philadelphia.

Contact our office to learn more at 267-423-4130. Get details and. Comments and Suggestions Concerning Notice of Proposed Rulemaking Department of Revenue 61 Pa.

1 A transfer to the United States or the Commonwealth or to an instrumentality agency or. Section 91193 - Excluded transactions a Excluded partiesA transaction in which all parties are excluded parties under 91192a relating to excluded parties is excluded from tax. Not in your case.

November 13 2000. Bellevue in Allegheny County charges 15 in transfer taxes. Senior Assistant Counsel.

2 Under Federal State and City laws corporations and associations are entities separate from their members. Philadelphia Transfer Tax Regulations. Office of Chief Counsel.

On December 8 2016 the Philadelphia City Counsel signed an ordinance amending Philadelphias realty transfer tax. The Philadelphia Bar Association founded in 1802 is the oldest association of lawyers in the United States. For example in michigan state transfer taxes are levied at a rate of 375 for every 500 which translates to an effective tax rate of 075 375 500 075.

If no sales price exists the tax is calculated using a formula based on the property value determined by the Office of Property Assessment OPA. Both grantor and grantee are held jointly and severally liable for. The Council of the City of Philadelphia finds that.

Philadelphia Real Estate Transfers and Inheritance Taxes. 1 There are business economic and tax reasons for entities holding real estate to do business as corporations or associations. Sugar-Sweetened Beverage Tax Regulationspdf.

Effective december 15 2007 the pennsylvania department of revenue department amended its realty transfer tax regulations. In Philadelphia for example 3278 is paid to the city along with the 1 paid to the Commonwealth. Philadelphia transfer tax law excludes 28 transactions while pennsylvania transfer tax law excludes 34 transactions.

1092 unless otherwise noted. If you are aware of a change or see an error please let know - EMAIL. Scheduled reductions to birt continue for tax year 2018.

The current rates for the Realty Transfer Tax are. 1259 approved june 11 1987 these regulations have been Transfers to an excluded party by gift or. Expedited rulings are issued within 20 days of the receipt of a complete and proper request.

The most important new provision is designed to shut down the perceived loophole for 8911 transactions. Amended through March 26 1971 effective March 27 1971 1 PaB. Our offices can work with you to determine if your real estate transaction may qualify and can help you take the necessary steps to create and record your deed and claim the exemption.

One percent of the selling price of a home is directed to the states Department of Revenue. If the house was transferred properly into your name 2 years ago it will not be subject to the Pennsylvania Inheritance. The State of Pennsylvania charges 1 of the sales price and the municipality and school district USUALLY charge 1 between them for a total of 2 ie.

Here is the list of the deed transfer tax rate exceptions. Tax Section Comments Concerning Proposed Realty Transfer Tax Regulations. 32833292 unless otherwise noted.

Before july 1 2017 if a real. 2 X 100000 2000. Hear from those who administer these taxes and find out new developments Hear about recent significant Philadelphia law amendments Review recent realty tax cases rulings and regulations Review practice examples Hear from the lawyers who wrote the regulations work on rulings and assist in deciding cases to pursue.

Some municipalities charge more or less. Transfer tax on the sale of the relinquished property is based on the 10000 sales. The full regulations for School Income Tax.

The provisions of this Chapter 91 adopted May 10 1967. Philadelphia Beverage Tax Regulations - Amendments to Section 101 and 401. It is important to know when you may be eligible for one of the many transfer tax exemptions.

8 2016 the philadelphia city council unanimously passed bill no. Department of Public Health. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term lease or other writing.

The tax imposed by the local government and school district varies from place to place. The Pennsylvania Inheritance Tax of 45 applies to transfers to children at death and includes all gifts made within one year of the date of death. 507 rows AMENDMENT TO THE REAL ESTATE TRANSFER TAX REGULATIONS.

The https in the address bar means your information is encrypted and can not be accessed by anyone elsehttps in the address bar means your information is encrypted and can not be accessed by anyone else. Philadelphia transfer tax regulations. Think of the transfer tax or tax stamp as a sales tax on real estate.

Code Chapter 91 Realty Transfer Tax RTT Realty Transfer Tax. Other provisions expand the definition of real estate company for purposes of the Citys transfer tax and further.

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Philly Council Votes To Require Affordable Housing In Some Neighborhoods

How To Avoid Transfer Taxes In Long Term Leases In Pennsylvania Legal Developers

Get Paypal Transfer Western Union Transfer Bank Transfer Moneygram Transfer Logins Cctop Up Western Union Money Transfer Western Union Money Market Account

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

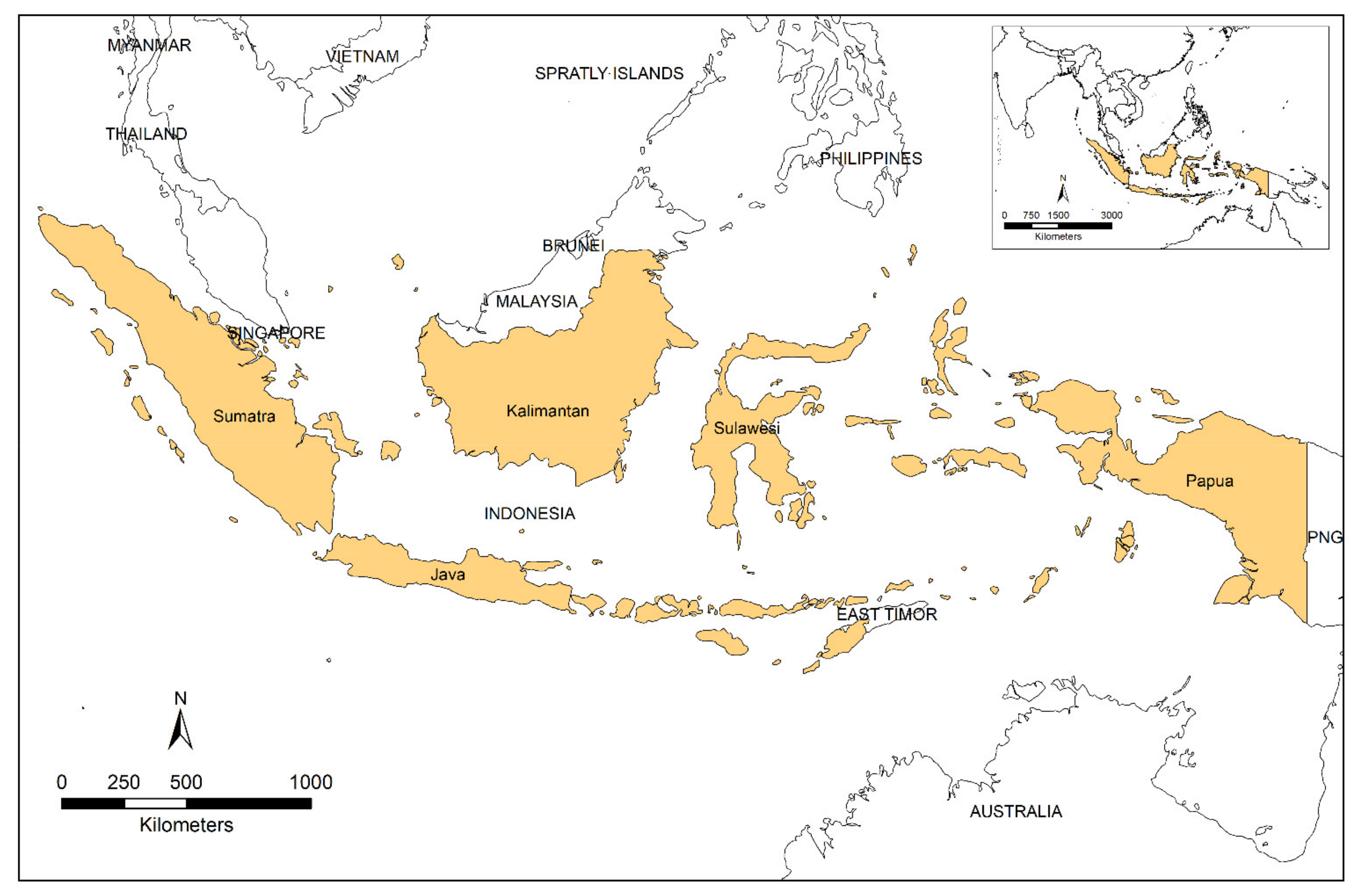

Land Free Full Text Incentives For Palm Oil Smallholders In Mandatory Certification In Indonesia Html

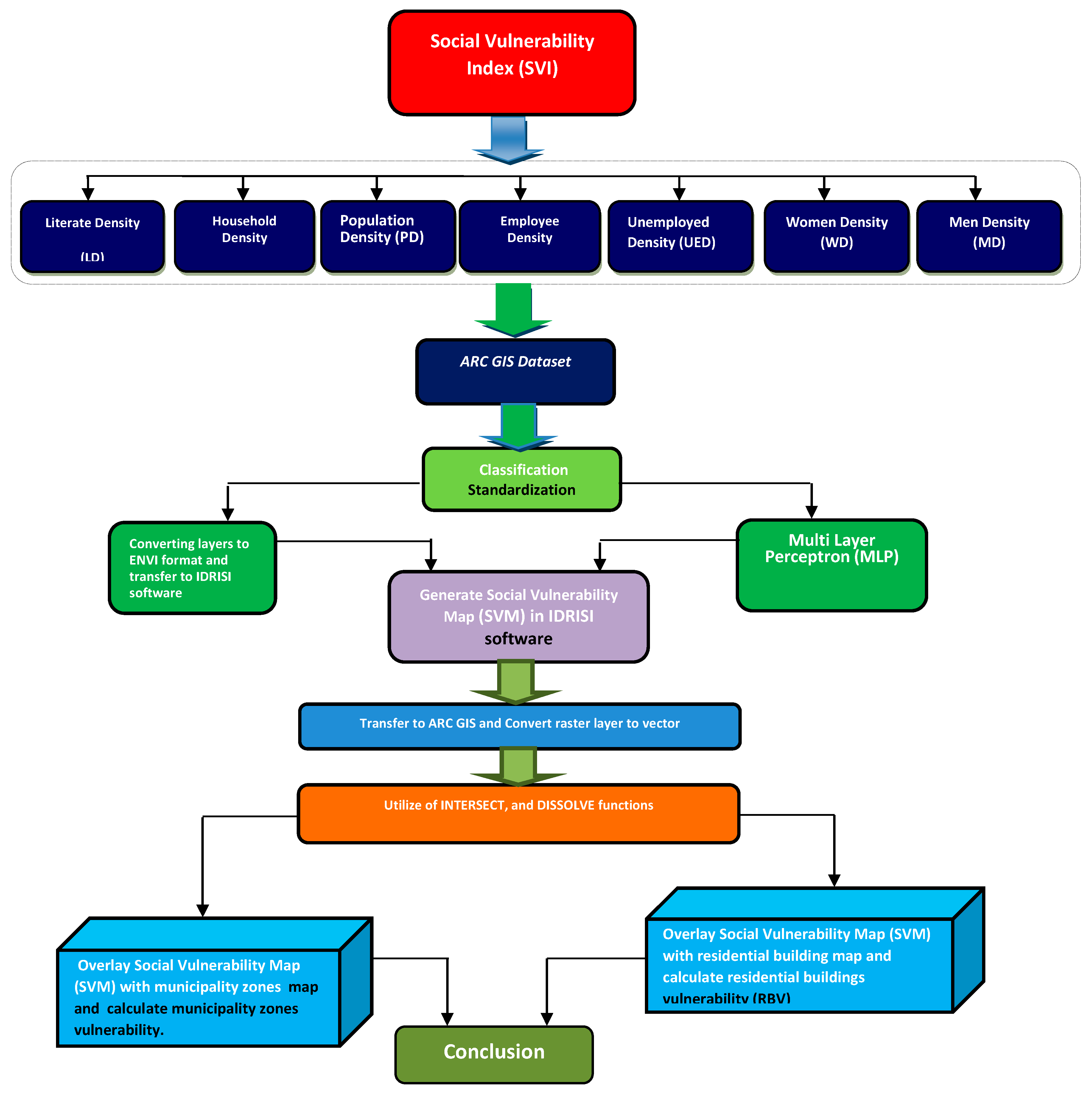

Sustainability Free Full Text Social Vulnerability Assessment Using Artificial Neural Network Ann Model For Earthquake Hazard In Tabriz City Iran Html

How To Build A Payment App For Money Transfer Case Study Chi Software

Sugar Skull Svg File For Cricut Calavera Rose Flower Vector Clipart Decal Svg Files For Cricut Sugar Skull Clip Art Svg

Shipbuilding Contracts By Universitetsforlaget Issuu

Skills Informasjonsteknologi Og Medieproduksjon By Gyldendal Norsk Forlag Issuu

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp