can you charge tax on a service fee

Service charges are always subject to sales tax while the treatment of delivery fees varies from state to state. Sales Tax on Service Charges Tips and Delivery Fees.

Etsy Botches Implementation Of New Canadian Tax Laws Cindylouwho2

A 1000 bill with a 20-percent service charge an 8.

. The prohibited fees list above sends a definite messagethe financial. As you can read from the above tax service fees are not permitted to be passed on to the borrower. 2 days agoSome companies like Telus have already announced new credit card processing fees.

Because of your particular situation there is no easy answer to this question. In some states businesses must charge sales tax on services provided in conjunction with sales of physical goods. The entire 23 charge is subject to sales tax because the entire amount is not paid over to employees.

The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the. Service charges are often taxed in some states. Since service charges are categorized as regular wages for tax calculation purposes employers are required to deduct payroll taxes before distributing to employees.

Taxes would be calculated by adding the service charge to the bill. 6875 state general rate sales tax. An optional payment designated as a tip gratuity or service charge is not subject to tax.

You can also charge service fees which are convenience fees just for education or government entities and they can be either a flat fee or a percentage of the transaction 0. Tip and service charges can complicate payroll taxes. For example a service whos work includes creating or.

Tips or Service Charges for These Items. A mandatory payment designated as a tip gratuity or service charge is included in taxable gross. When it comes to sales tax the general rule of thumb has always been products are taxable while services are non-taxable.

You may sometimes have to charge sales tax while at other. The true object test can. 63 base charge per person 18 service fee 18 of 63 1134 6 sales tax 6 of 63 378 Total cost per person7812 So I guess the short answer is no our service fee.

Objects in the mirror may appear tax-free. In some states businesses must charge sales tax on services provided in conjunction with sales of physical goods. While 1666 might not seem a sufficient deterrent adding any late fee can encourage your client to move your invoice to the top of the pile and pay it promptly.

What to Do Before You Charge a. The true object test can help determine service taxability. Under that scenario if your business sells coffee.

Any local and special local taxes that apply. While most services are exempt there are a few exceptions. As you can read from the above tax service fees are not permitted to be passed on to the borrower.

Are Subject to These Taxes. In the state of Massachusetts services are not usually taxable. The new rule which allows merchants to pass fees on to consumers goes into effect on.

A caterer charges its customers an 8 service charge and a 15. When are services subject to California sales tax.

What Small Business Owners Need To Know About Sales Tax

California Use Tax Information

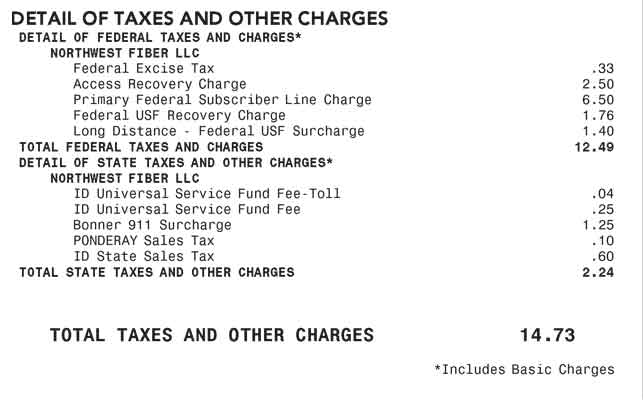

Wireless Taxes And Fees Jump Again 2018 Don T Mess With Taxes

Services Charges Vs Tips Must Know Implications

Should Your Studio Charge Sales Tax For Your Classes After Class

Is There Anything I Can Do To Reduce 20 In Fees R Att

Other Services Archives Monroe County Tax Collector

Government Taxes Fees At T Community Forums

Service Providers Are You Making This Big Sales Tax Mistake Sales Tax Institute

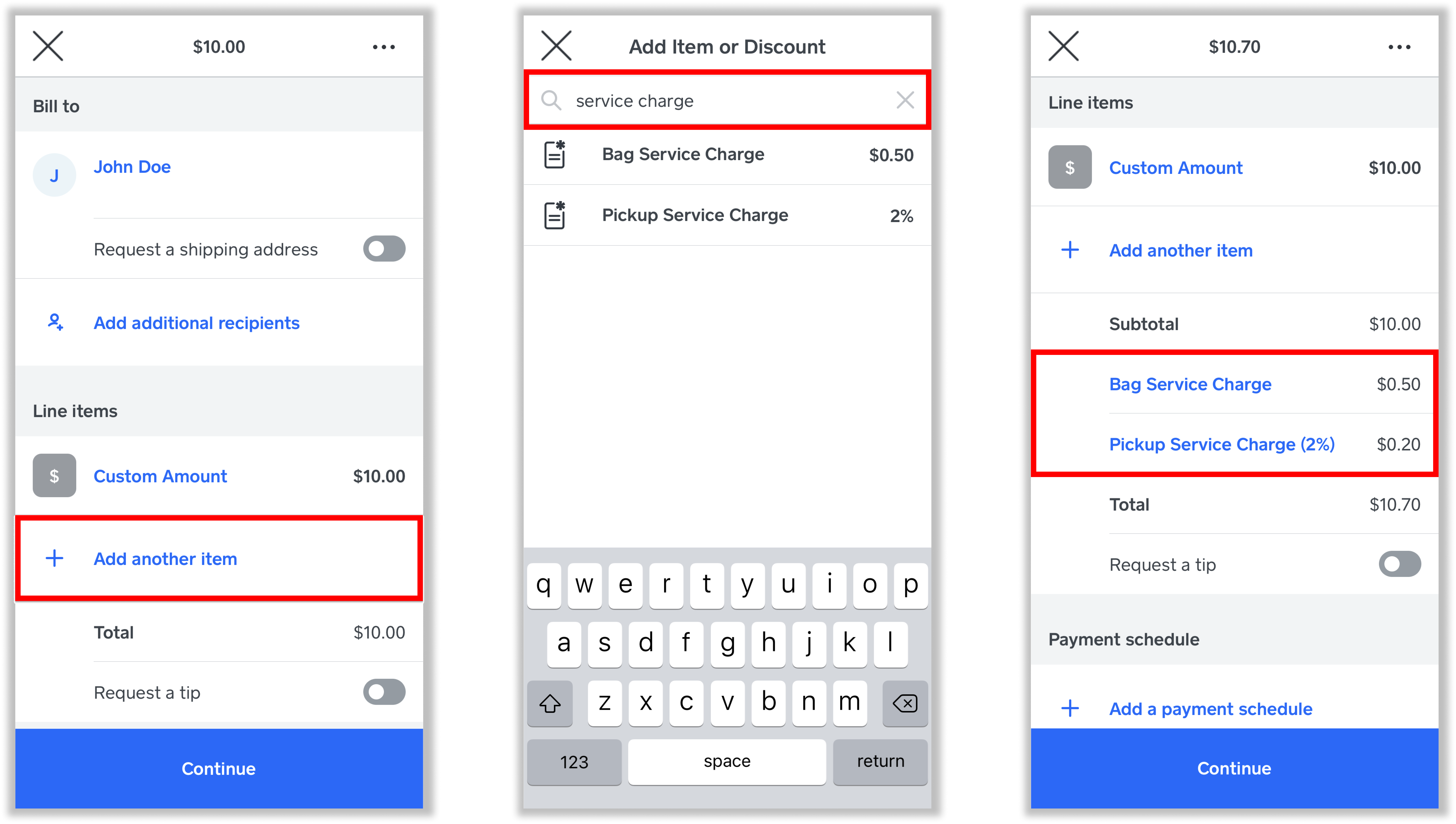

How To Create A Service Charge

What Is The Difference Between A Service Tax And A Service Charge Quora

You Paid For It Hidden Fees Hidden Taxes Wrgb

Get Started With Service Charges Square Support Center Us

Cash App Taxes 100 Free Tax Filing For Federal State

How To Calculate Service Charge Tax For Your Indian Wedding Venue Indian Wedding Venues United States And Canada